Stretch Ira Rules 2024. The era of the stretch ira. Secure act rewrites the rules on stretch iras.

Leaving behind a huge tax bill for your heirs with the stretch ira scuttled? The irs has said that they expect to release final guidance in 2024.

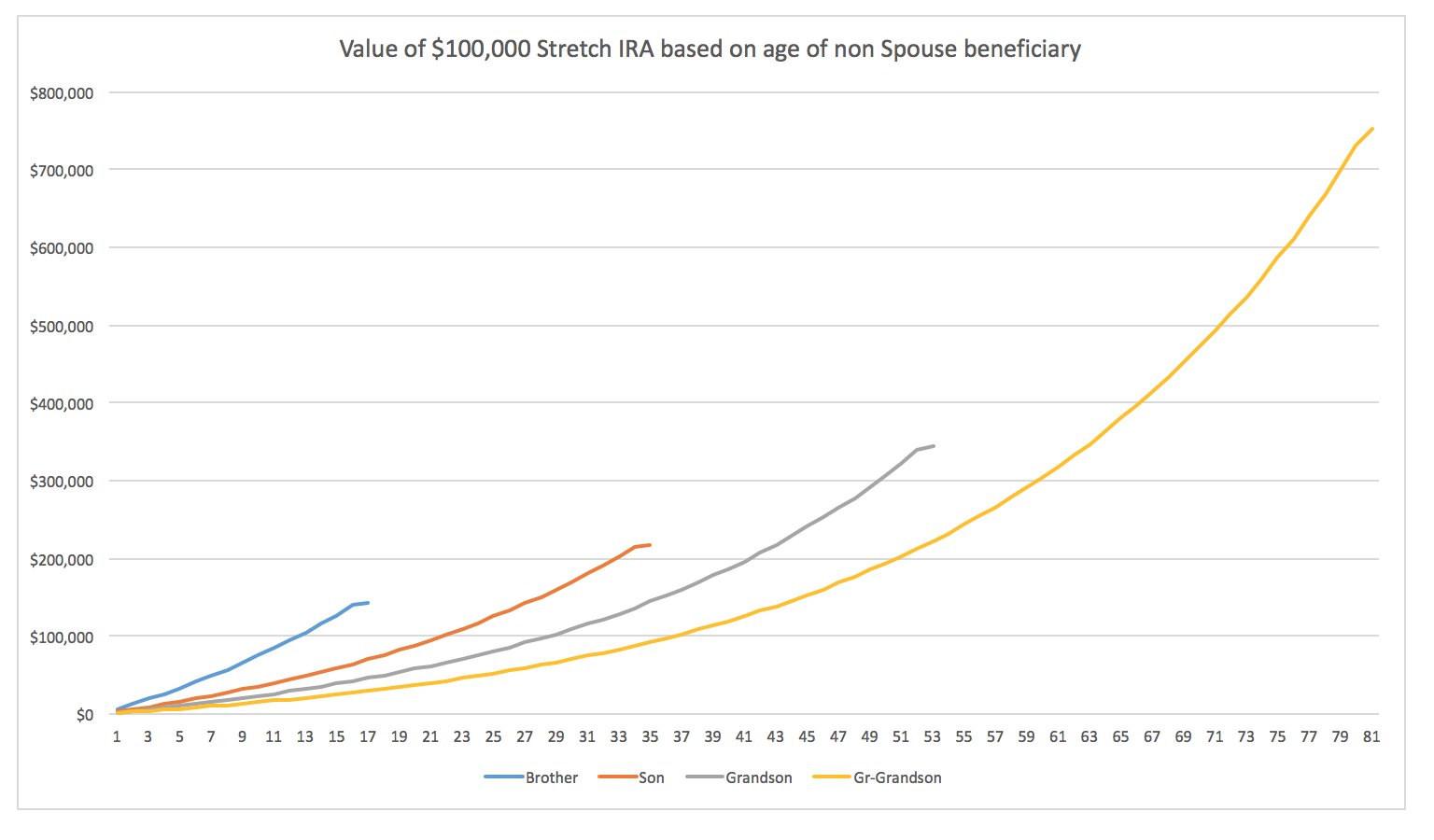

A stretch ira was a way to limit required distributions on an inherited ira, avoiding a sizable tax bill in the process.

The setting every community up for retirement enhancement (secure) act, enacted as part of a federal spending bill, makes substantial changes to the rules.

Three Stretch IRA Alternatives Coastal Wealth Management, Inherited ira rules & secure act 2.0 changes. Contribute as much as possible.

SECURE Act Stretch IRA Rules Pure Financial Advisors, Information on this page may be affected by coronavirus relief for retirement plans and iras. The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older).

New stretch IRA rules could make this type of trust more popular Saving, It's important to understand the updated inherited ira distribution rules tied to the recent. Information on this page may be affected by coronavirus relief for retirement plans and iras.

Understanding a Stretch IRA Saverocity Finance, The era of the stretch ira. Bart massey | jun 03, 2022

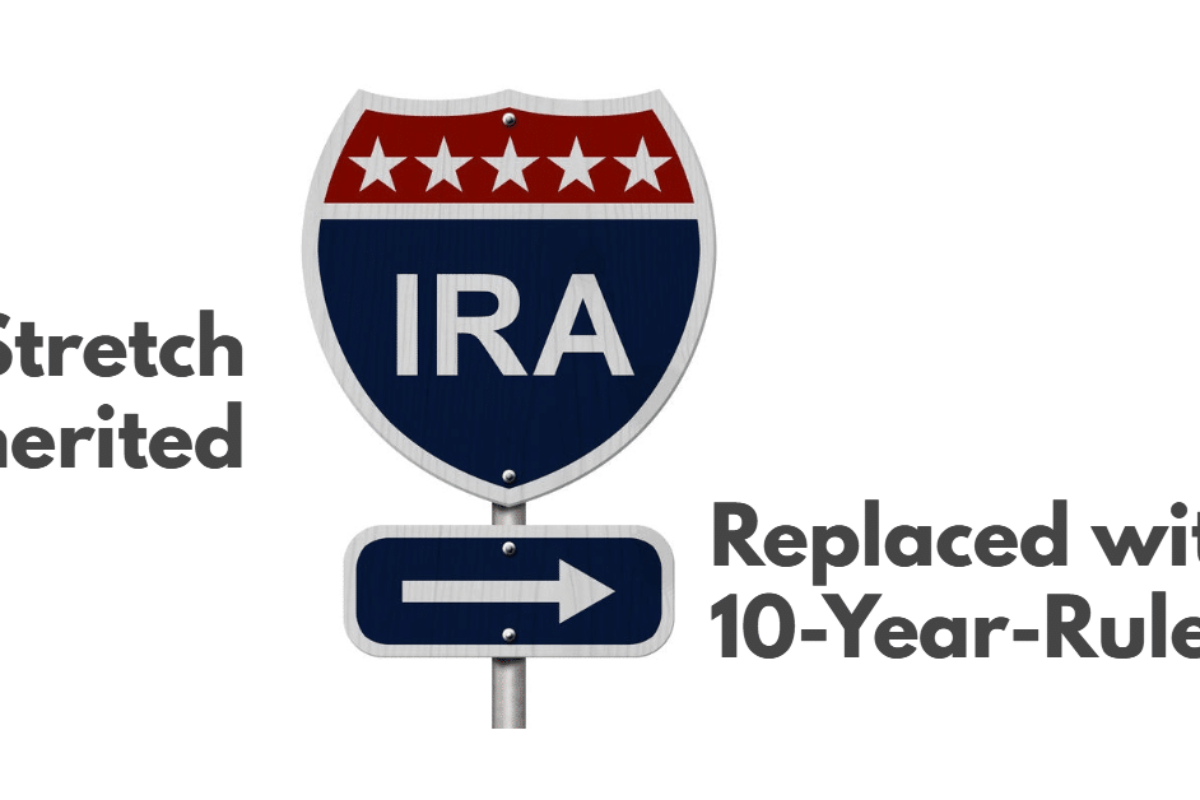

Stretch IRA Rules Good Life Wealth Management, Under the secure act, an inherited ira must now be fully distributed to the beneficiary within ten years, except if the beneficiary is a surviving spouse, an eligible. If you qualify to tuck away money in a roth ira in 2024, you'll be able to tap into the biggest contribution limits we've ever seen.

View as HTML EquiTrust, Leaving behind a huge tax bill for your heirs with the stretch ira scuttled? A stretch ira was a way to limit required distributions on an inherited ira, avoiding a sizable tax bill in the process.

"Stretch IRA" Rules May be Revised for Inherited Retirement Accounts, A stretch ira was a way to limit required distributions on an inherited ira, avoiding a sizable tax bill in the process. Inherited ira rules & secure act 2.0 changes.

The Stretch IRA is Dead. What's Next? Law Offices of Robert J. Varak, Elimination of the stretch ira: Information on this page may be affected by coronavirus relief for retirement plans and iras.

The SECURE Act is the law for 2020 & your Large IRAs Ashok Sanghavi, Under the secure act, an inherited ira must now be fully distributed to the beneficiary within ten years, except if the beneficiary is a surviving spouse, an eligible. The ipl 2024 is set to introduce several rule changes compared to the previous season.

New Proposed Stretch IRA Rules Will Have A Big Effect On IRAs And It, The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older). Contribute as much as possible.